“The nitty-gritty is that header bidding allows publishers to offer their premium ad inventory without the risk of underselling it. “

Some hold Charles the 1st as the pioneer of auctioning art. In the early 1600s, he individually priced his famous collection and invited specific purchasers to join the “auction”, but the process was slow and tedious. It wasn’t until the mid-1700s, when Edward the Earl of Oxford hired out Covent Garden to auction his massive collection, that most say was the first true art auction, at least in modern recorded history. What was different? Each item was sold under the hammer and to none other than the highest bidder.

History repeats itself, and in 2009 tiny pieces of commercial art, ad creatives, began to be automatically auctioned to optimize the value of a publisher’s inventory. Much like Charles the 1st, with every piece of art having its price, ads were served by “daisy-chaining”, aka waterfalling, where the bid of each advertiser had to meet the minimum price set. As programmatic technology has advanced, much like Earl Edward’s Covent Garden auction, automated ad serving has shifted to header bidding auctions, in which only the highest bidder wins under a simultaneous “hammer”.

If you like some more historical context for our industry, you must read Partnering with Transparency.

This brief article will uncover:

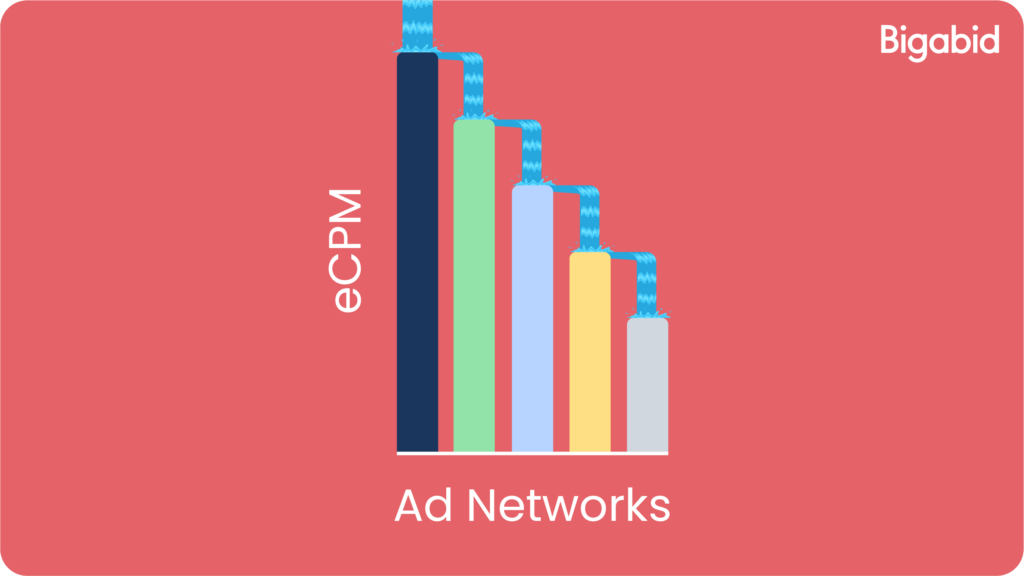

A programmatic waterfall (aka daisy-chaining) starts with a chain of ad networks/exchanges arranged in order of their performance for any given publisher from top to bottom. The network/exchange performance is typically rated based on CPM, fill rate, latency, etc.. Ad impressions are passed from network to network, from top-rated to bottom-rated ones until they’re sold.

The CPM decreases as an impression falls down the waterfall, but so does the inventory. The waterfall attempts to ensure that no inventory is left unsold while hopefully procuring the publisher the best possible price. This way, publishers mainly use this technique to sell remnant ad inventory.

In the early days, publishers used to sell their best ad inventory as direct deals, but they were left with lots of ad inventory that wasn’t interesting to buyers. They developed the programmatic waterfall to solve this problem.

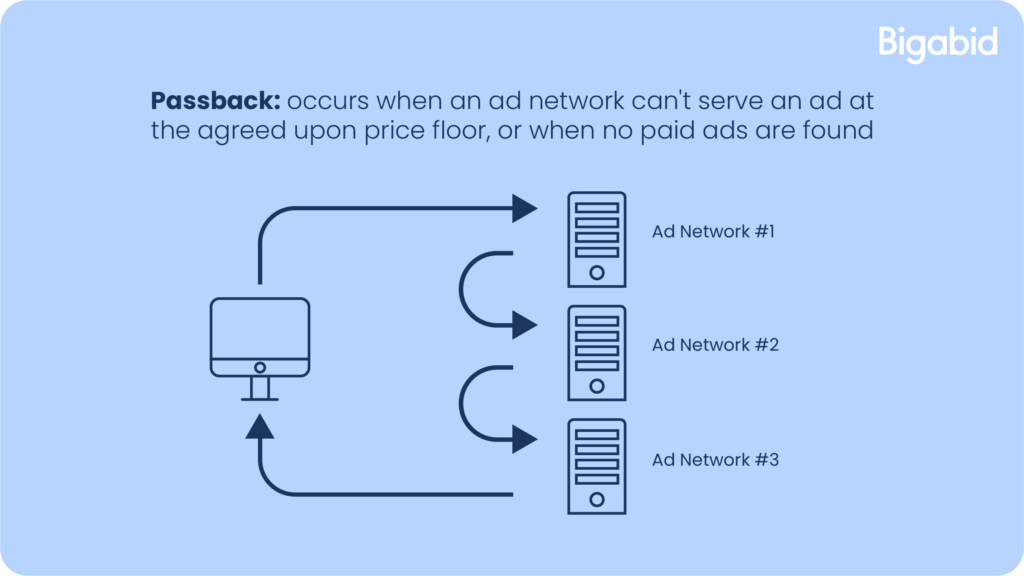

The primary disadvantage is that publishers receive a low yield (CPM/ROI) because the ad networks bid on impressions in a daisy-chain sequence instead of simultaneously in RTB (Real-Time Bidding). Once the impressions are passed (aka passback) to the next ad network, the bid floor decreases and the probability for higher CPM decreases as well. In addition, potentially higher CPMs in the following ad networks will be ignored since the waterfall chain stops when a bid is higher than the bid floor was set.

Discover more about Bigabid’s real-time data analysis in relation to RTB in Real-Time Data Analysis.

In addition, since the waterfall is sequential and not simultaneous, there is a high degree of latency. The passback (when no one wants the impression at the publisher’s price) means that the impression, having made its way down the waterfall, is finally returned to a fallback ad server, causing even more latency.

Finally, when publishers send impressions to a preferred SSP (supply-side platform) with a higher price floor, if it doesn’t sell, they lower the price for a second SSP, and so on. This waterfall in price can end up clearing the impression for pocket change, when if a buyer had been aware that they could have bought that inventory for a little less, they would have. All of this adds up to a lower ROI for publishers.

The waterfall model is not a viable solution in 2022, though publishers still use it to organize their ad inventory or test “the waterfall” before RTB by giving certain advertisers an exclusive first look at their inventory. This relates to PMP (private marketplace) deals, which is an invite-only marketplace for publishers to sell their premium inventory directly to select buyers. Essentially, PMPs combine the efficiency of programmatic and exclusivity of direct deals.

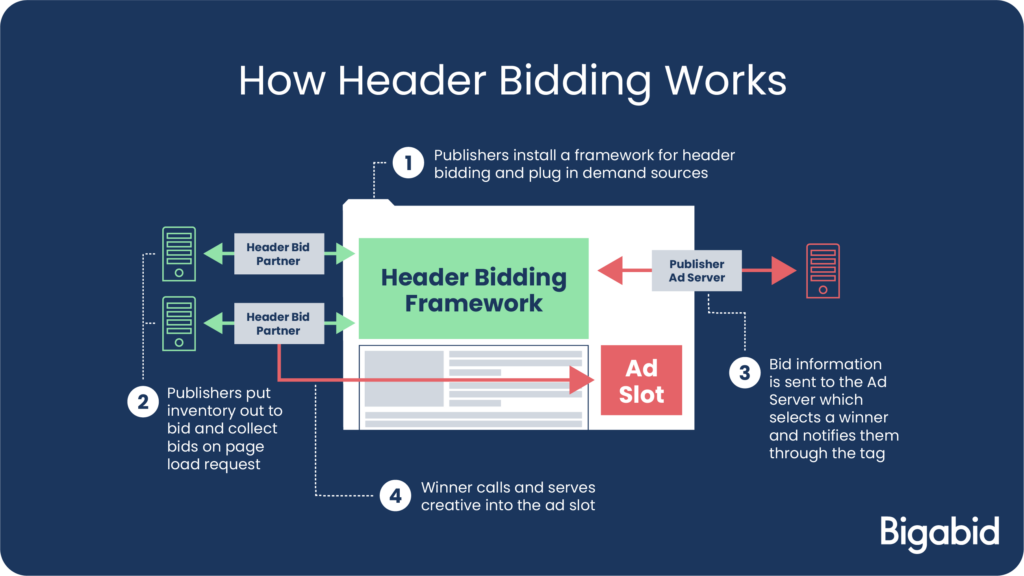

To solve the expensive problems of waterfall auctions for publishers, programmatic header bidding was developed, which is the industry standard today.

Programmatic header bidding is a true auction. Publishers sell their inventory through multiple ad exchanges (auction houses), giving multiple demand-side Partners (buying agents) the option to bid on that inventory (lots) simultaneously. And unlike the set prices in both Charles the 1st’s auction and a programmatic waterfall, in programmatic header-bidding, the highest bid always wins, just like Edward’s ground-breaking art auction.

Want more details? The core of head-bidding is the header code that publishers place in the header. Each time someone visits an app, it requests an ad to be served. The server then sends the request to an SSP (supply-side platform), which allows publishers to sell inventory programmatically. Then the SSP pushes the request forward to an ad exchange, the marketplace that serves as a trading center between supply and demand partners. The ad exchange then forwards it to a DSP (demand-side platform), the advertiser’s ace in the pocket ML (machine-learning) used to manage their user acquisition or retargeting campaigns. The DSP analyzes all the relevant data and matches the inventory to the advertiser via precision targeting. Finally, the Advertisers bid on their targeted audience. The one who bids the highest price wins. This all happens, more or less, simultaneously.

Since header bidding reaches multiple demand partners in RTB (real-time bidding), publishers maximize their yield for their ad inventory by selling it at the highest price. The nitty-gritty is that header bidding allows publishers to offer their premium ad inventory without the risk of underselling it.

What makes inventory premium? Learn more about ad creatives in Creative Personalization.

The waterfall model is not a common solution in 2022. Publishers still use it to organize their ad inventory or test “the waterfall” before RTB. They may also use it to give certain direct buy advertisers an exclusive first look at their inventory. All in all, header bidding is the new standard in the programmatic world.

Check out some of Bigabid’s greatest success stories with programmatic head bidding in our Case Studies.

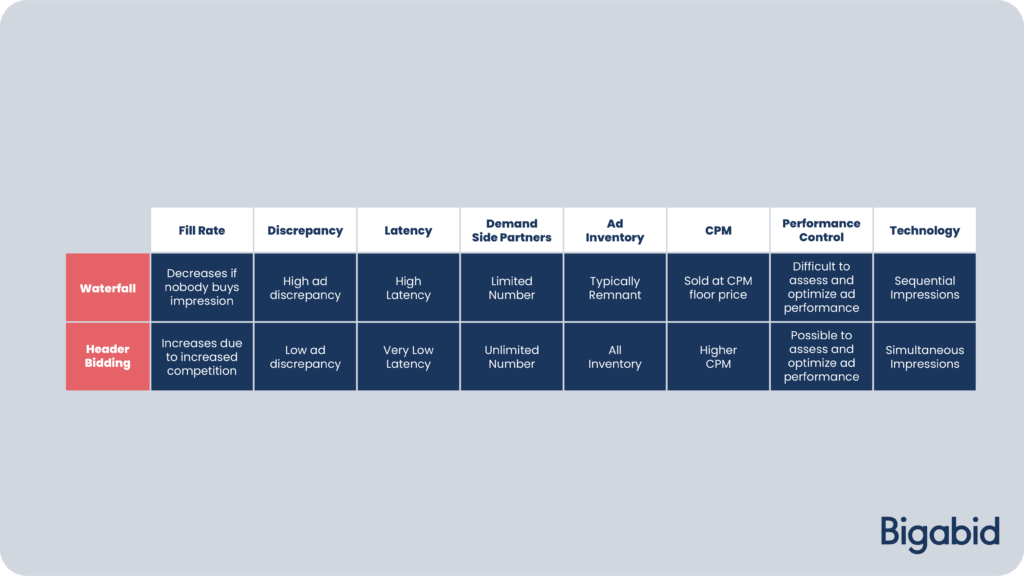

Here is a simple rundown in a comparison table:

From the mid-1600s to the mid-1700s, auction technology progressed much like waterfall has to header bidding in recent times. Fortunately, today things are progressing much faster. As a second-generation DSP, Bigabid is at the forefront of programmatic technology, an exciting place to be as we are devoted to helping our industry improve and evolve. Get in touch to be part of this revolution while improving your campaign ROIs!